The ultimate staffing payroll solution

Accurate. Efficient. Every time

Built for staffing agencies

Payroll

Ontime and accurate, the way it should be

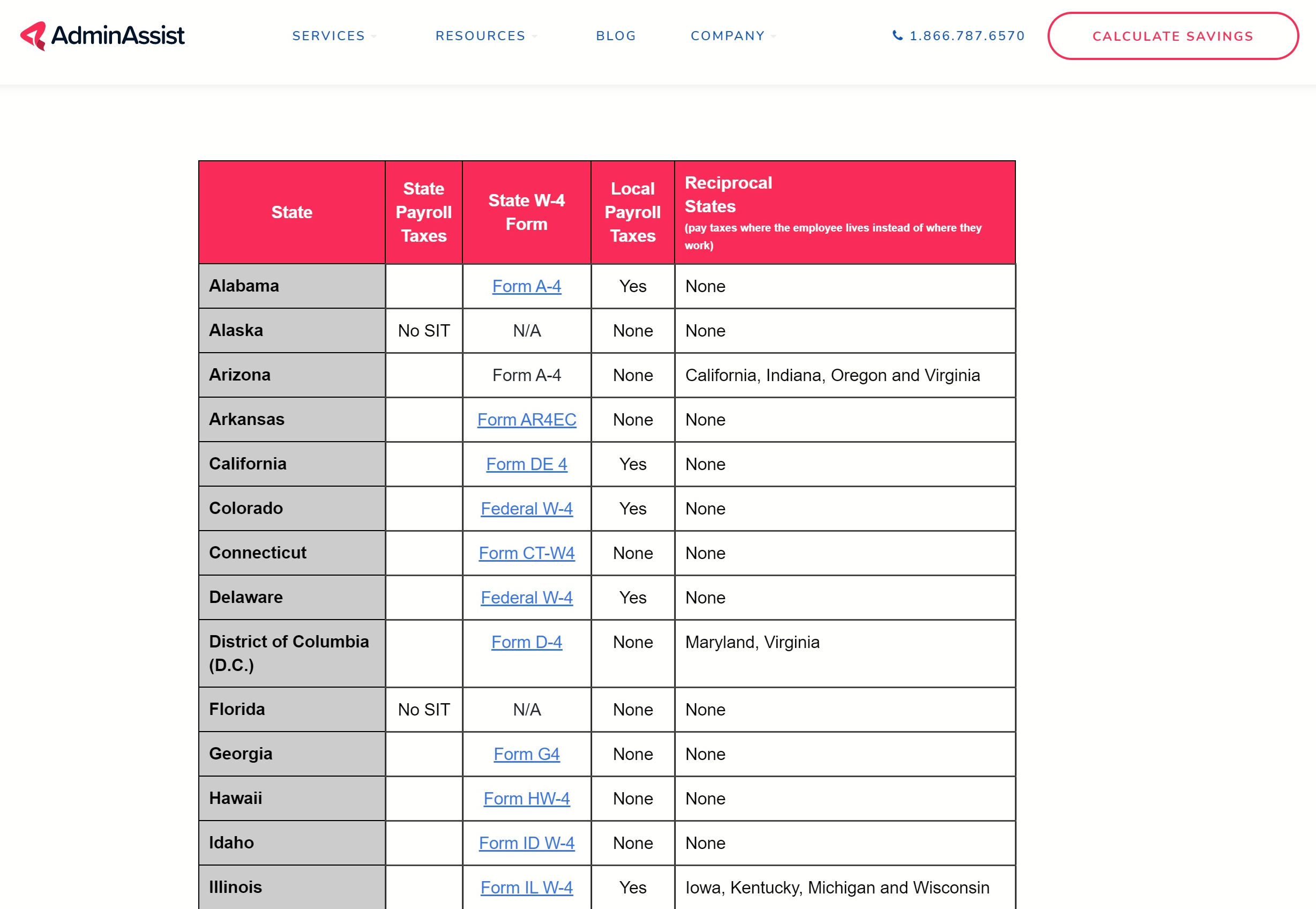

Taxes

Federal, State, and local payroll taxes processed and filed accurately

Benefits

Streamline the process between HR, Accounting, Payroll, and your workforce

The difference between a satisfactory back-office provider and an exceptional one is often very small, subtle, hidden-from-view practices and details - yet those differentiators have proven to have giant, blatant, undeniable effects on our bottom line.

In my staffing career I worked with 3 other firms before I was connected with AdminAssist, and I can't imagine a future in which I'd ever consider other options. Their expertise goes well beyond the skills you could ever expect from an internal hire, and yet it has always felt like they're just as much a part of our team as anyone else.

At Next Move, Inc. we are all Raving Fans of AdminAssist!

John Nolan

Owner, NextMoveIncluded services

Per Diem

Garnishments

Paid Time-off

Direct Deposit

Pay Stub Delivery

Unemployment Filings

1095-C Forms

1099/W2 Forms

Payroll Tax Payments

Federal Payroll Tax

State & Local Tax Setup

State & Local Tax Filings

* Additional services and details provided with a free quote

Additional Services

customized for your every need

Easy. Straight forward processing

-

1

Approve & submit time detail

Our clients have the option to provide an export from their time system and/or use the AA time reporting tool. Our time import system is a flexible solution to accept time from a variety of time systems as well as VMS time exports (i.e., Bullhorn, Bullhorn One, SpringAhead, TSheets, Beeline, Fieldglass, IQ Navigator, etc.).

-

2

Review and audit

Upon receiving your time file, we review and audit the file for accuracy and abnormalities in items such as overtime, billable hours, etc.

Once approved, the file is imported into the accounting system for a secondary audit. This step provides alerts regarding time issues such as exited placements, missing ID's, etc.

-

3

Payroll processing begins

Audited payroll files are pulled into the payroll system for processing.

This is where we will make any one-off payroll changes (i.e., benefit double deductions retro-pay adjustments, pro-rated salary adjustments for termed employees, etc.).

-

4

Payroll finalized, sent, and reports delivered

The final review is completed and we accept and close the payroll for processing

Copies of payroll reports are then uploaded to your client portal for your convenience review and reference at any time.

Check out the latest from us

Subscribe to get the latest from us

You can unsubscribe at any time.